Digital measuring systems revolutionize insurance claims processing by leveraging precise, data-driven assessments to minimize errors and fraud in auto glass replacement and fender repair. These technologies streamline collision repair processes, leading to faster turnaround times, efficient resource allocation, quicker claim settlements, and enhanced customer satisfaction. However, navigating the digital age requires a focus on data accuracy and security, with verification methods and robust cybersecurity protocols essential to prevent disputes and maintain trust.

Digital measuring systems are revolutionizing the insurance claims process, offering unprecedented precision and efficiency. This technology enables faster, more accurate assessments by capturing detailed data, reducing manual error, and streamlining claim verification. From home inspections to damage documentation, digital systems provide a comprehensive, traceable record, enhancing transparency and trust. However, ensuring data accuracy and security remains paramount, as these systems handle sensitive information. By addressing these challenges, digital measuring systems promise a future of smoother, more reliable insurance claims handling.

- Revolutionizing Claims Process: Digital Measuring Systems' Role

- Advantages: Enhanced Precision and Efficiency

- Navigating Challenges: Ensuring Data Accuracy and Security

Revolutionizing Claims Process: Digital Measuring Systems' Role

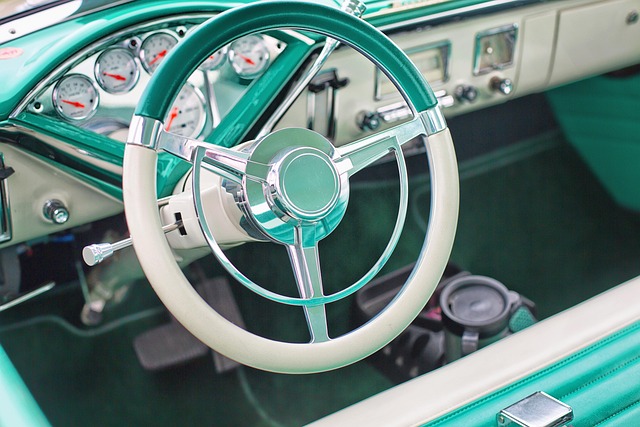

The insurance claims process has undergone a significant transformation with the advent of digital measuring systems. These advanced technologies are revolutionizing how insurers handle claims, particularly in areas such as auto glass replacement and fender repair. By leveraging precise, data-driven assessments, digital measuring systems ensure accurate damage evaluations, reducing the potential for errors or fraud that can plague traditional methods.

This new approach streamlines collision repair processes, enabling faster turnaround times and more efficient allocation of resources. Whether it’s measuring the extent of a crack in a windscreen or assessing the dimensions of a dented panel, digital systems provide detailed, objective data. This information empowers insurance providers to make informed decisions, facilitating quicker claim settlements and enhancing customer satisfaction, especially when compared to the time-consuming manual measurements used in past practices.

Advantages: Enhanced Precision and Efficiency

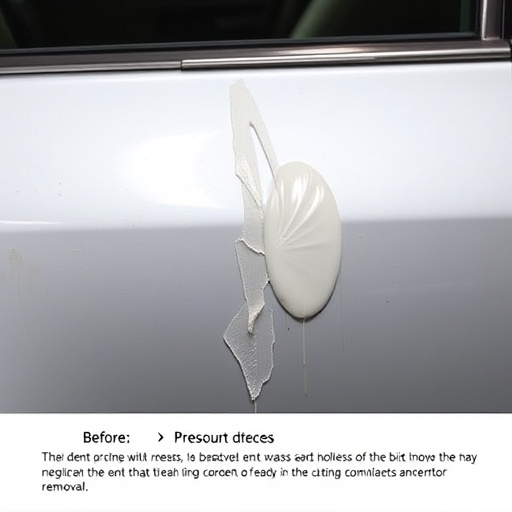

The advent of digital measuring systems has revolutionized the landscape of insurance claims processing. These innovative tools offer a plethora of advantages, with enhanced precision and efficiency being at the forefront. Traditional methods often relied on manual measurements, which were time-consuming and prone to human error. Digital systems, however, utilize advanced sensors and software to capture precise data, ensuring accurate assessments every time. This level of accuracy is particularly beneficial when dealing with intricate claims, such as those involving paintless dent repair or car collision repair.

By automating the measurement process, insurance providers can significantly streamline their workflow. Claims adjusters can quickly capture detailed information about damage, enabling faster decision-making and settlement times. Moreover, digital measuring systems reduce the need for physical measurements, minimizing the risk of errors and delays associated with traditional on-site inspections. This efficiency translates to better customer satisfaction, as claims are resolved more promptly, benefiting both policyholders and insurance companies alike.

Navigating Challenges: Ensuring Data Accuracy and Security

Navigating Challenges: Ensuring Data Accuracy and Security

In the age of digital measuring systems, the insurance claims process is undergoing a significant transformation. However, this shift comes with its own set of challenges, particularly in maintaining data accuracy and security. As more processes become automated, the onus lies on insurers and repair centers to ensure that digital measurements are precise, as even minor discrepancies can lead to claims disputes. For instance, when assessing damage to vehicles at a collision center or determining the extent of scratch repairs, inaccurate data can result in unfair settlements or prolonged claim processing times.

Moreover, with sensitive customer information being exchanged digitally, robust security measures become imperative. Insurers and repair facilities must employ advanced cybersecurity protocols to safeguard personal and financial details from potential cyber threats. This includes encrypting data transmission, utilizing secure cloud storage, and implementing strict access controls to prevent unauthorized access. By addressing these challenges head-on, digital measuring systems can enhance the efficiency of insurance claims while ensuring customer trust and data integrity.

Digital measuring systems are transforming the insurance claims process by offering enhanced precision and efficiency. They provide accurate, data-driven assessments, speeding up claim settlements and reducing costs. However, navigating challenges such as ensuring data accuracy and security is essential for reliable and secure operations. As these systems continue to evolve, insurers can leverage their capabilities to deliver improved customer experiences and maintain a competitive edge in the market.